our firm

Our mission is to generate superior returns by making investments in great businesses and helping management better them.

Family Origins

Our origins are a family office founded in 1947. In 1994, we opened our private equity investment activities to outside investors seeking attractive risk-adjusted rates of return.

Values-Based Investing

Our investment philosophy is rooted in partnership with great companies and their existing management teams.

Our Experience

One flagship strategy across nine funds

32

YEARS

In Private Equity

23

BILLION

Committed Capital

80

TOTAL

Investments

Our Portfolio of Companies

Scaled companies in a wide variety of industries that are growing market share

24

CURRENT

Investments

45

BILLION

Revenue

5.0

BILLION

EBITDA

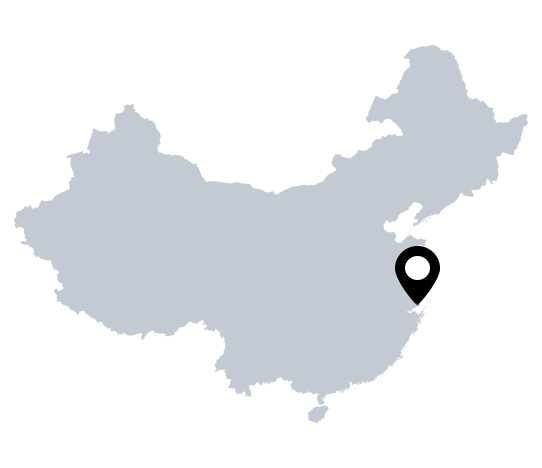

53

Countries

153,000

Employees

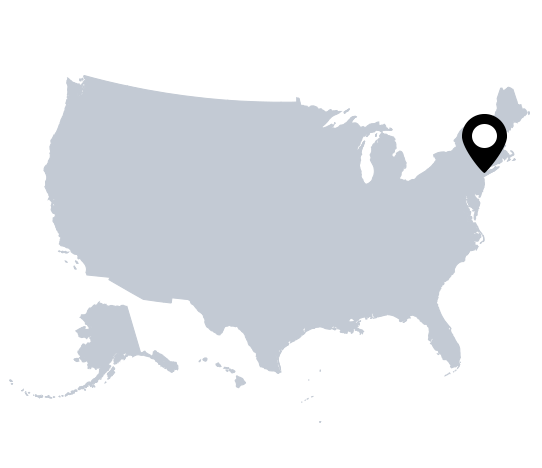

Our Offices

We partner with management teams to drive long-term value. Meet our team.